All you need to know

as a beginner about

stock markets, investments,

trading & more..

When it comes to growing your wealth steadily and sensibly, mutual fund investment is often one of the most recommended options. It’s a professionally managed financial vehicle where money from multiple investors is pooled together and invested in stocks, bonds, and other securities. This collective investment allows even small investors to benefit from the expertise of fund managers and diversification of a wide portfolio.

But what exactly is a mutual fund? Is it truly safe for long-term wealth building? What are the common misconceptions people have? Let’s dive deep into these questions and much more.

Mutual fund investment means putting your money in a fund that is managed by professionals, who invest that money in various financial instruments like equities (stocks), debt (bonds), gold, etc., depending on the type of mutual fund chosen.

The objective is to generate returns over time, based on the fund’s investment strategy. Whether you're a conservative investor looking for steady income or an aggressive one eyeing high returns, there’s a mutual fund designed for every risk appetite.

Is mutual fund a good investment?

Yes, mutual funds are considered a good investment for both long-term and short-term goals. They offer diversification, professional management, and liquidity. However, returns are market-linked and carry risks.

What if I invest ₹ 10,000 in mutual funds?

Investing ₹ 10,000 can be a smart start. Depending on the fund type and market performance, your money can grow over time. Equity mutual funds may offer higher returns but come with higher risk, while debt funds are more stable but offer moderate returns.

Can I invest ₹ 5,000 in a mutual fund?

Absolutely. In fact, most mutual funds in India allow investment through SIP (Systematic Investment Plan) starting from as low as ₹500/month. So ₹5,000 is more than enough to begin your journey.

What is mutual fund investment?

It is a method of investing where you pool your money with others to buy into a professionally managed portfolio. This could include stocks, bonds, or other assets based on the fund’s goal.

Many people still hesitate to invest in mutual funds due to a lack of understanding or myths, such as:

NAV (Net Asset Value) is the price per unit of a mutual fund. It represents the value of one unit of a mutual fund scheme on a given day.

NAV = (Total Assets – Total Liabilities) / Total Number of Units Outstanding

It changes every business day based on the market value of the fund's underlying securities.

Should I buy a mutual fund with low NAV?

Not necessarily. Focus on the fund’s past performance, portfolio, risk level, and consistency, not just the NAV.

Yes, mutual funds sahi hai, but with a strategy.

Long-Term:

Equity mutual funds work best here. Over 5–10 years, they tend to outperform traditional instruments like fixed deposits or gold.

Short Term

Debt mutual funds or liquid funds are safer choices for goals within 1–3 years.

The key is aligning your investment horizon and risk tolerance with the right type of fund.

You can begin with:

This flexibility makes mutual funds ideal for all income groups.

FII (Foreign Institutional Investors) and DII (Domestic Institutional Investors) play a significant role in the stock market, which in turn impacts mutual funds.

Thus, tracking FII/DII activity can give you insight into potential fund performance.

Mutual funds, especially equity funds, are closely tied to the stock market.

Bull Market:

Higher valuations and better returnsBear Market:

Lower valuations and temporary lossesThat’s why long-term investment is key—short-term volatility often evens out in the long run.

Gold and silver serve as hedge assets. When equity markets are volatile, these assets may perform better.

However, it’s essential to diversify. Don't invest solely in gold or metals, but use them to balance your portfolio.

Yes, Gold Bees and other gold-based mutual funds can be a smart choice:

Hedge against inflation

Portfolio diversification

Good for conservative investors

But remember — gold may not generate as high returns as equities in a bullish cycle. Use it as part of a broader plan.

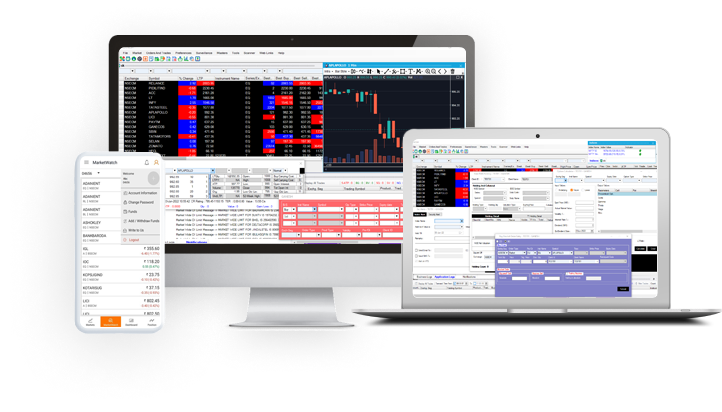

If you're ready to begin your investment journey, Ganesh StockInvest is your trusted partner with over 30 years of financial expertise. We offer more than just a platform — we provide comprehensive investment support to help you invest smartly and confidently.

Why choose Ganesh StockInvest?

Regular Reports

Get detailed investment reports and performance analysis, accessible anytime and anywhere.Online and Offline Support

Fast, secure online transactions and doorstep services, especially helpful for senior citizens.Portfolio Management

Personalized advice to create and manage a diversified portfolio aligned with your long-term financial goals.Mobile Application

Access your portfolio, reports, and transaction history anytime, anywhere through our mobile app.We are proud to be associated with India’s most trusted Asset Management Companies (AMCs), ensuring you get access to a wide variety of mutual fund schemes:

With Ganesh StockInvest, you get access to top-performing mutual funds, expert insights, and dependable service under one roof.

Before investing, understand:

Don’t put all your eggs in one basket. Diversify your investments.

A SEBI-registered mutual fund advisor can help:

Platforms like Ganesh StockInvest provide such professional help and ensure your investment journey is safe and informed.

AIFs are fast gaining popularity among HNIs and seasoned investors.

Category I AIF

Focus on startups, SMEs, social venturesCategory II AIF

PE funds, debt funds (e.g., real estate funds)Category III AIF

Hedge funds, complex strategiesThough AIFs require a higher investment (typically ₹ 1 crore minimum), they offer high potential returns, diversification, and active management.

They’re ideal for long-term wealth creation, particularly in real estate, private equity, or debt markets.

Let’s answer some more questions people frequently ask:

Mutual fund investment is a smart way to build wealth, diversify your portfolio, and achieve financial goals—be it retirement, buying a home, or children's education. While the market does have its risks, proper planning, diversification, and professional help can reduce uncertainty and maximize returns.

Whether you’re a beginner or a seasoned investor, starting with even ₹500/month through Ganesh StockInvest can open the door to financial freedom.

So, the answer to the popular query “Kya mutual fund sahi hai?” is a resounding YES, provided you:

Start your mutual fund investment online with Ganesh StockInvest today!

Grow your money smartly, safely, and systematically.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily