All you need to know

as a beginner about

stock markets, investments,

trading & more..

Investing in stocks is one of the most powerful ways to build wealth over time — but it’s also an environment that can punish haste, hype, and overconfidence. This post explains why investing in stocks can help you reach long-term goals, why many young investors (especially Gen Z) have recently experienced losses, and exactly what steps to take next — with plain language, real data, and an actionable checklist you can follow today.

Younger retail investors are now a material force in markets. Recent global research shows a sharp increase in the number of Gen Z who start investing early: in many economies, roughly 3 in 10 Gen Z begin investing in early adulthood — far higher than prior generations — and a large share learn about investing well before entering the workforce.

A deeper look at what Gen Z holds shows heavier allocation to speculative assets: one institutional study found Gen Z’s top current investments include cryptocurrency (55%), individual stocks (41%), and ETFs/mutual funds below that — indicating many young investors combine speculative bets with direct-stock ownership.

Retail-trading platforms and social media have made trading cheap and viral — which increased participation but also amplified speculative trading and short-term behavior that can lead to losses for inexperienced traders. Academic and industry research shows trading-app users are more likely to trade frequently and take on speculative positions, which raises the chance of short-term losses.

Why this matters for you: more Gen Z are investing earlier — and more are learning via social feeds and apps — which creates opportunity and risk at the same time.

Long-term Growth Potential

Historically, equities have outperformed most other asset classes over multi-decade periods. For long horizons, stocks can compound wealth faster than savings accounts.

Inflation Beat

Stocks are a common hedge against inflation because company earnings and asset values tend to rise with the economy.

Accessibility & Low Cost

Modern brokers (including app-first platforms) let you start with small amounts, fractional shares, and low/no commissions — making investing in stocks accessible to Gen Z.

Liquidity & Choice

You can enter and exit positions on public exchanges quickly and choose across thousands of sectors and companies.

Learning & Engagement

Active investing teaches financial literacy: reading company reports, understanding macro cycles, and building discipline.

Long-term Growth Potential

Historically, equities have outperformed most other asset classes over multi-decade periods. For long horizons, stocks can compound wealth faster than savings accounts.

Inflation Beat

Stocks are a common hedge against inflation because company earnings and asset values tend to rise with the economy.

Accessibility & Low Cost

Modern brokers (including app-first platforms) let you start with small amounts, fractional shares, and low/no commissions — making investing in stocks accessible to Gen Z.

Liquidity & Choice

You can enter and exit positions on public exchanges quickly and choose across thousands of sectors and companies.

Learning & Education

Active investing teaches financial literacy: reading company reports, understanding macro cycles, and building discipline.

These advantages explain why so many young people are drawn to investing in stocks — but they don’t remove the very real risks, especially for short-term traders.

Short-termism and Emotional Trading

Buying into hype (meme stocks, trending tickers) or panicking on dips leads to selling low and buying high. Trading-app data and behavioral research confirm that easy access increases impulsive trades, which correlate with losses.

Concentration Risk

Holding a small number of speculative stocks magnifies downside when one position collapses. Many young investors concentrate in a few trending names.

Leverage & Margin

Using borrowed money to trade magnifies both gains and losses; inexperienced traders can quickly wipe out capital.

Lack of Emergency Savings

Research finds a large share of young adults lack adequate emergency funds, which forces them to sell investments at bad times to meet cash needs.

Overexposure to Crypto & High-Volatility Assets

Heavy bets on crypto or penny stocks can result in rapid, large losses. CFA Institute and other surveys show Gen Z often holds crypto and speculative assets.

Short-termism and Emotional Trading

Buying into hype (meme stocks, trending tickers) or panicking on dips leads to selling low and buying high. Trading-app data and behavioral research confirm that easy access increases impulsive trades, which correlate with losses.

Concentration Risk

Holding a small number of speculative stocks magnifies downside when one position collapses. Many young investors concentrate in a few trending names.

Leverage & Margin

Using borrowed money to trade magnifies both gains and losses; inexperienced traders can quickly wipe out capital.

Lack of Emergency Savings

Research finds a large share of young adults lack adequate emergency funds, which forces them to sell investments at bad times to meet cash needs.

Overexposure to Crypto & High-Volatility Assets

Heavy bets on crypto or penny stocks can result in rapid, large losses. CFA Institute and other surveys show Gen Z often holds crypto and speculative assets.

Start with financial fundamentals: emergency fund, budget, debt plan. Many losses come from trading without a safety net.

Move from “trend-chasing” to process-driven investing: asset allocation, diversification, periodic rebalancing.

Use small allocations for speculative bets, not the whole portfolio. Treat high-volatility trades like entertainment capital, not retirement capital.

Step 1

Stop the bleeding: immediate actions (first 30 days)

Step 2

Diagnose what went wrong

Step 3

Rebuild with a safe, simple portfolio (3–12 months)

Step 4

Skill up (continuous)

Step 5

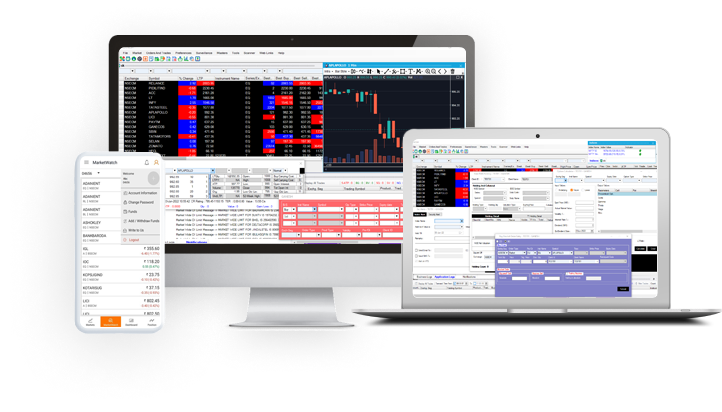

Use technology wisely

As you rebuild, use broker features that support discipline and education:

If you already use Ganesh Stock, look for tools that let you set recurring investments, view historical performance, and access company financials — these will turn hobby trades into informed investments.

For a Gen Z investor with ₹200,000 investable savings

Numbers vary by income, age, and goals — but the structure helps: emergency fund → core → satellite.

The World Economic Forum’s Global Retail Investor Outlook and CFA Institute’s Gen Z research are great starting references for broader trends and behaviors.

If you’re a Gen Z investor who’s recently taken losses, you’re not alone — the data shows this younger cohort is highly active but also exposed to short-term dynamics that can produce losses. The good news: with a practical plan (emergency fund, diversified core, small speculative sleeve, and disciplined rules), you can convert today’s lessons into tomorrow’s advantage.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily