All you need to know

as a beginner about

stock markets, investments,

trading & more..

In today’s fast-paced world, understanding the basics of investment is essential for securing financial stability and building long-term wealth. Whether you're aiming for early retirement, funding your children's education, or simply looking to beat inflation, investing plays a crucial role.

his guide is crafted to help beginners grasp the foundational principles of investing, with a special focus on the basics of investment, basics of investment in stock market, and basics of investment in share market.

Investment is the process of allocating money with the expectation of generating income or profit over time. Unlike saving, which keeps money idle in a bank, investing puts your money to work. Whether in stocks, bonds, mutual funds, or real estate, investments aim to increase your financial worth over the long haul.

The basics of investment include knowing your financial goals, assessing your risk tolerance, choosing the right investment vehicles, and maintaining a diversified portfolio. Here’s a breakdown:

Set Financial Goals:

Clearly define what you are investing for—

short-term goals (like a vacation), medium-term (buying a car), or long-term (retirement).

Assess Risk Tolerance:

Understand how much risk you are comfortable with. Generally, higher returns come with higher risks.

Know Your Time Horizon:

The duration you plan to hold an investment affects what kind of assets you should invest in.

Diversify:

Don’t put all your eggs in one basket. A mix of asset types reduces the risk.

Stay Informed:

Keep up with market trends, economic news, and financial literacy.

By understanding these basic principles, you lay the foundation for smart investment choices.

Stocks are bought and sold on stock exchanges. Investors can make money through price appreciation and dividends.

To buy or sell stocks, you need a brokerage account.

Bull markets are rising markets; bear markets are falling ones. Understanding these trends helps in timing your investments.

These are platforms like the New York Stock Exchange (NYSE) or India’s National Stock Exchange (NSE).

A market order buys/sells at the best available price. A limit order sets a specific price at which you're willing to buy/sell.

A portion of a company's earnings shared with shareholders. Not all stocks pay dividends.

Mastering the basics of investment in stock market helps investors make informed decisions and manage their risks effectively.

In the primary market, companies issue new shares (IPOs). In the secondary market, investors trade existing shares.

A key metric that helps assess whether a share is over or under-valued.

Institutional investors, promoters, and retail investors contribute differently to stock price movements.

Before buying shares, understand how a company is valued - look at earnings, growth prospects, and industry position.

Indicates how much a company pays out in dividends relative to its share price.

Getting acquainted with the basics of investment enhances your confidence and analytical skills as an investor.

Educate Yourself:

Read books, watch videos, and follow financial news.

Start Small:

Begin with a small amount in mutual funds or ETFs to understand how markets work.

Choose a Brokerage:

Select a reliable platform with good customer support and easy-to-use interfaces.

Automate Investments:

Set up SIPs (Systematic Investment Plans) to invest consistently.

Open a Demat & Trading Account:

To begin investing, you need to open demat account and trading account, which allow you to hold and trade securities electronically.

Review Periodically:

Check your portfolio regularly and rebalance if necessary.

Educate Yourself:

Read books, watch videos, and follow financial news.

Choose a Brokerage:

Select a reliable platform with good customer support and easy-to-use interfaces.

Open a Demat & Trading Account:

To begin investing, you need to open demat account and trading account, which allow you to hold and trade securities electronically.

Start Small:

Begin with a small amount in mutual funds or ETFs to understand how markets work.

Automate Investments:

Set up SIPs (Systematic Investment Plans) to invest consistently.

Review Periodically:

Check your portfolio regularly and rebalance if necessary.

Always align your investments with your financial goals.

Putting all money into one stock or sector increases risk.

Letting fear or greed drive decisions can be detrimental.

Just because others are investing in a stock doesn't mean you should.

Trying to predict market movements often leads to poor decisions.

Be patient. Wealth building takes time.

Reinvest dividends and earnings.

Consult financial advisors for personalized strategies.

Stay informed about financial markets.

Use tax-advantaged accounts when available.

Mastering the basics of investment is the first step toward a financially secure future. With a sound understanding of the basics of investment in stock market and the basics of investment in share market, you empower yourself to make smart, informed decisions. As you grow in experience, your confidence will increase, and so will your wealth.

Whether you're just getting started or looking to refine your approach, remember that consistent learning and disciplined investing are the cornerstones of long-term financial success.

Ready to begin your investment journey? Start today, and let your money work for you!

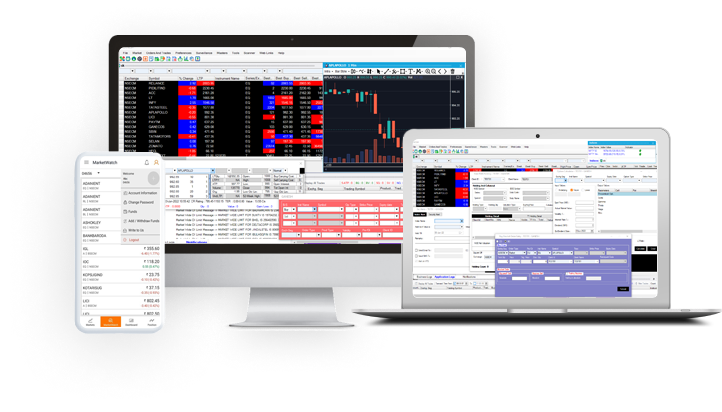

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily