All you need to know

as a beginner about

stock markets, investments,

trading & more..

In today’s fast-paced financial world, investors are constantly searching for ways to grow their wealth, preserve capital, and navigate ever-changing market dynamics. While traditional investment avenues—such as gold, fixed deposits, or real estate—still hold value, a growing number of individuals are now turning to the stock market for higher, more scalable returns. However, success in the stock market doesn’t come from guesswork. It comes from strategy, understanding, patience, and discipline.

This blog takes a deep educational look at stock market trading, exploring how opportunities emerge, how traders can convert them into profits, and the specific strategies used by seasoned market participants. Whether you’re a beginner wanting clarity or an investor seeking to refine your approach, this guide is your fresh perspective on building confidence in the world of equities.

Stock market movements aren’t random. Every price change—no matter how small—is fueled by one of three forces:

Being able to read and interpret these forces gives traders the ability to spot opportunities long before the average participant. The essence of stock market trading is not predicting the future—it’s recognizing high-probability setups based on evidence.

Successful traders understand that opportunities don’t appear every day; they emerge when the right fundamentals, technical indicators, or economic conditions align. This is where knowledge becomes your competitive edge.

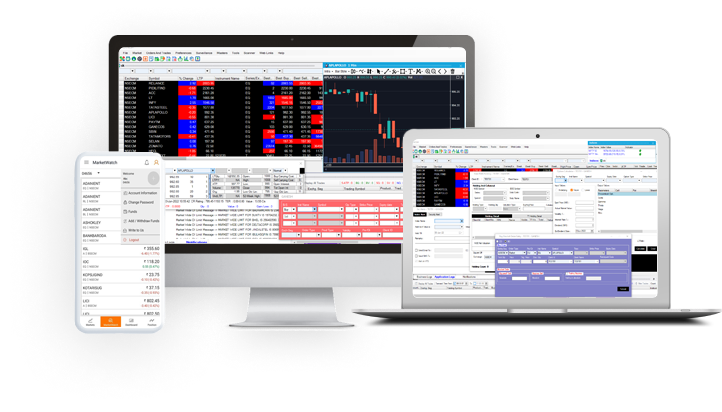

Earlier, trading was limited to professionals working on exchange floors. Today, digital platforms, algorithmic insights, and real-time data have completely transformed the experience.

The modern trader has:

Access to instant market information

Tools like candlestick charts, indicators, and screeners

Learning resources for deep knowledge

Global access to financial markets

Lower transaction costs and no paperwork

Mobile-based trading platforms

Because of this evolution, stock market trading is no longer an elite skill—it’s accessible, learnable, and profitable for anyone willing to commit./p>

With this transformation in mind, let’s dive into how the market creates opportunities that traders can systematically convert into profits.

Market opportunities arise from several factors. Understanding them helps you anticipate market behavior earlier than most participants.

Earnings reports, mergers, product launches, or management changes can drastically influence stock prices.

For example:

Traders monitor these triggers to catch the move early.

GDP, inflation, interest rates, and global policies influence investor sentiment.

A rate cut by the Reserve Bank of India may lead to:

Understanding these cycles allows traders to position themselves in the right sectors.

The chart reflects all available information and future expectations. When certain patterns appear—like breakout levels, support bounces, or reversal signals—they indicate opportunity.

Common examples:

Technical traders rely heavily on these setups.

Foreign Institutional Investors (FIIs) are major influencers in Indian markets. When they buy heavy volumes, markets rise; when they sell, markets fall.

Monitoring institutional activity gives traders insights into future market direction.

Crude oil prices, geopolitical tensions, or international economic updates often open profitable windows for short-term traders.

Volatility is not a risk—it’s a chance, if you manage it well.

Before diving into advanced strategies, let’s revisit essential principles that form the backbone of stock market trading.

The market rewards those who can control losses. Even the best traders do not win every trade—but they make sure losing trades don’t wipe out their capital.

Key elements:

In simple terms: protect your capital first, profits come later.

Fear, greed, overconfidence, panic—these emotions destroy more capital than bad strategies.

A disciplined trader:

Mastering mindset is the hardest but most important part of stock market trading.

Different traders use different time frames:

Choosing the right time frame depends on your risk appetite, time availability, and financial goals.

This section covers the core strategies used by seasoned traders across global markets. Each is explained so even beginners can understand and apply them in real trading situations.

A trend exists when prices consistently move in one direction.

Tools used:

Traders enter when the trend is confirmed and exit when it weakens.

A breakout occurs when the price moves above resistance or below support with high volume.

Example:

Successful breakout traders wait for:

It’s one of the most effective strategies in stock market trading.

Reversal traders seek market turning points.

Indicators used:

This strategy offers high rewards but requires experience to identify genuine reversals.

When a short-term moving average crosses a long-term moving average, it signals a trend change:

Ideal for positional traders.

Volume shows the strength behind price movements.

Golden rule:

Understanding volume filters out false trades and improves accuracy.

This strategy requires quick reaction and a strong understanding of market behavior.

Events include:

Event-driven traders capitalize on volatility but always use strict stop-loss orders.

Swing traders capture medium-term price moves over several days or weeks.

Tools used:

Swing trading is ideal for working professionals because it requires less screen time.

Here’s a simplified model you can use in real-life trading:

Use stock screeners to find:

Use both fundamental and technical analysis.

Check indicators, chart patterns, and market sentiment to inform your trading decisions.

Do not enter blindly. Choose:

Non-negotiable.

Stops protect your capital.

Set realistic profit targets (2–5% in short trades, more in swings).

Every trade teaches you something — document your trades for long-term improvement.

Even with the right strategy, many traders lose money because of avoidable errors.

Avoiding these mistakes is just as important as learning strategies.

The next generation of traders will be driven by knowledge, data, and technology—not guesswork.

Learning how markets behave, understanding strategies, and applying disciplined execution are the only sustainable ways to profit consistently.

Whether you are a beginner or an intermediate trader, continuous education will help you improve your trading accuracy and decision-making.

Stock market trading is not about predicting the future—it's about making informed decisions based on patterns, data, discipline, and strategy. Market opportunities appear every day, but only educated traders know how to evaluate them and turn them into consistent profits.

With a fresh perspective, strategic mindset, and risk-managed approach, anyone can navigate the stock market with confidence. If you stay disciplined, learn continuously, and follow proven strategies, the market will reward you over time.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily