All you need to know

as a beginner about

stock markets, investments,

trading & more..

India’s markets move fast. Between the pre-open market, intraday swings, corporate actions, and late-evening press release drops, there’s a flood of information. This guide shows you how to follow Market Live News Updates efficiently, do practical Stock Market Analysis, and act on credible data from NSE, BSE, and Moneycontrol. We’ll also show how a full-service, SEBI registered broker like Ganesh StockInvest can simplify online stock trading, IPO applications, mutual fund investment, and more.

Quick win: Bookmark your three sources of truth

India has two primary exchanges—BSE (Asia’s oldest, 1875) and NSE (1992). Both run fully electronic, order-driven markets, regulated by SEBI. The front-page indices are Sensex (BSE) and Nifty 50 (NSE). If you’re doing Stock Market Analysis, you will inevitably anchor to these two benchmarks and their sector cousins (Bank, Auto, IT, FMCG, etc.).

Market Timing: When Trades Actually Happen

Re-open market (price discovery):

09:00–09:15 IST (order entry modification, matching/ confirmation windows). This is where the market absorbs major overnight news

Regular trading session (cash market):

09:15–15:30 IST.

Post-close/closing session:

Mechanics vary (e.g., closing price formation, post-market). Always check the current NSE note for any special timings like Muhurat Trading on Diwali.

Holidays:

Follow the official annual calendars from NSE/BSE. (Media lists are

helpful but rely on the exchange

calendars.)

Knowing these slots helps you plan day trading vs long term actions: use pre-open for gap analysis, the first hour for momentum, midday for ranges, and closing prints for end-of-day signals. That’s practical Stock Market Analysis 101 backed by official schedules and Market Live News Updates.

Indices Watch

Use NSE/BSE index dashboards (headline and sector indices). Combine index breadth (advance/decline), sector heatmaps, and volatility (India VIX) to frame the day. Moneycontrol’s live indices page is handy for a single-view pulse. This is your core Stock Market Analysis step every morning.

Top 5 Gainers/Llosers

Scan Top 5 gainers/losers to spot leadership and laggards. Pair it with 52-week High/Low to judge whether movers are breaking out or just bouncing. On NSE, this data is in the Market Data section; BSE shows similar live tables. These feeds inform both day trading vs long term thinking.

52 Week High/Low

A breakout to a 52-week High often signals trend strength; conversely, a 52-week Low can warn of structural issues. Filter out illiquid names and confirm with volumes and recent press release or financial results.

Corporate Actions & Company Disclosures

Dividend, bonus, split, rights, buyback, voting results—these affect price behavior and your P&L. Exchanges host official notices; Moneycontrol aggregates them under company pages. Always verify price-sensitive items with exchange PDFs before trading on a headline.

IPO & Allotment Statuss

From DRHP buzz to listing day, track IPO updates on exchange sites and Moneycontrol. For retail, check allotment status via registrars and exchange notices; your broker app (e.g., Ganesh StockInvest) can show applied, allotted, and mandate status. Listing pops often correlate with issue quality and sentiment—build this into your Stock Market Analysis.

Sensex today live / Market Live News Updates

Keep a live news window open — "Sensex today live" blogs and tickers capture fast moves (policy headlines, deals, global cues). Moneycontrol runs real-time liveblogs; cross-confirm major prints with NSE/BSE. This is the purest form of Market Live News Updates that drives intraday decision-making.

Indices Watch

Use NSE/BSE index dashboards (headline and sector indices). Combine index breadth (advance/decline), sector heatmaps, and volatility (India VIX) to frame the day. Moneycontrol’s live indices page is handy for a single-view pulse. This is your core Stock Market Analysis step every morning.

Top 5 Gainers/Llosers

Scan Top 5 gainers/losers to spot leadership and laggards. Pair it with 52-week High/Low to judge whether movers are breaking out or just bouncing. On NSE, this data is in the Market Data section; BSE shows similar live tables. These feeds inform both day trading vs long term thinking.

52 Week High/Low

A breakout to a 52-week High often signals trend strength; conversely, a 52-week Low can warn of structural issues. Filter out illiquid names and confirm with volumes and recent press release or financial results.

Corporate Actions & Company Disclosures

Dividend, bonus, split, rights, buyback, voting results—these affect price behavior and your P&L. Exchanges host official notices; Moneycontrol aggregates them under company pages. Always verify price-sensitive items with exchange PDFs before trading on a headline.

IPO & Allotment Statuss

From DRHP buzz to listing day, track IPO updates on exchange sites and Moneycontrol. For retail, check allotment status via registrars and exchange notices; your broker app (e.g., Ganesh StockInvest) can show applied, allotted, and mandate status. Listing pops often correlate with issue quality and sentiment—build this into your Stock Market Analysis.

Sensex today live / Market Live News Updates

Keep a live news window open — "Sensex today live" blogs and tickers capture fast moves (policy headlines, deals, global cues). Moneycontrol runs real-time liveblogs; cross-confirm major prints with NSE/BSE. This is the purest form of Market Live News Updates that drives intraday decision-making.

Market Data: Beyond Last Traded Price

Market data is more than LTP. You need: best bid/ask, depth, traded volume, VWAP, delivery percentage, and intraday pivots. Use this along with index breadth and sector rotation to upgrade your Stock Market Analysis from “price watching” to “context-aware” trading. Moneycontrol’s instrument pages and NSE/BSE quotes give you these layers.

Pre-open Market Mechanics

From 09:00–09:15 IST, order entry and matching discover an equilibrium price for the open. Watch for overnight news impacts, block orders, and gap risk. Note: opening gaps often retrace partially—pair with sector indices and global futures to avoid chasing. Pre open market knowledge is essential for disciplined entries.

Corporate Actions, Financial Results, and Annual Reports:

1

Day Trading vs Long Term

Day trading vs long term is not a binary; it’s a time-horizon spectrum.

In both cases, build your plan around market timing, upcoming holidays (for settlement/mandates), and avoid trading through illiquidity pockets unless intentional.

2

Mutual Fund Investment

If you prefer low-maintenance compounding, mutual fund investment offers professionally managed exposure to equities, debt, and hybrids. Compare track records, mandates, and expense ratios from a reputable mutual fund company. Use your broker’s platform to set up SIPs, SWPs, and STPs. (Your broker’s research desk can map funds to your risk profile.)

3

LAS and LAP (Leveraging Responsibly)

Leverage magnifies Stock Market Analysis outcomes - positives and drawdowns. Use prudently with buffers for gap risk and corporate-action adjustments.

4

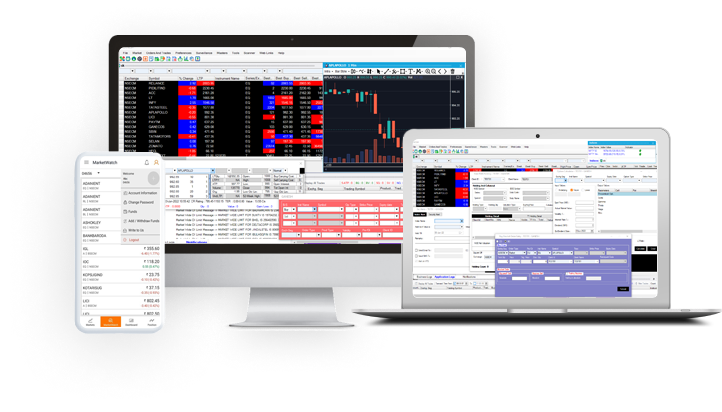

Online stock trading with a SEBI registered broker

A SEBI registered broker gives you compliant access, order routing, risk engines, and grievance redressal. Evaluate order types (regular, bracket, cover), margin policies, research support, and a mobile app that’s stable during high-volatility spikes.

Ganesh StockInvest (founded 1993, New Delhi) is positioned as a full-service partner for investors and traders—offering online stock trading, IPO application flows, and a mobile app designed for quick execution. If you want a one-stop stack (equity, derivatives, currency; research explainers; demat/onboarding support), their ecosystem is built for that.

Highlights you can use today

Mobile + web platform for invest in stock market, apply IPO, and monitor Market Live News Updates as you trade. Ganesh Stock

Long operating history (30+ years) and client education content (including Stock market Updates on YouTube, reels, and explainer posts).

Local support and demat assistance when you’re moving from watchlists to actual execution. (See their site and socials for contact details and onboarding flow.)

If you’re hunting for the best stock broking company for your specific needs, evaluate stability, support, product breadth, and whether the broker helps you translate Stock Market Analysis into practical, risk-aware trades. Ganesh StockInvest leans into that “full-service with education” niche while staying SEBI registered broker-focused and India-centric.

1

Indices watch (Nifty, Sensex, sector indices)

Open three tabs: • NSE indices; • BSE live indices; • Moneycontrol indices summary. This triangulates the market’s breadth and leadership—your starting point for Stock Market Analysis.

2

Pre-open Market Scan

At 09:00 IST, look at price discovery on key names (earnings reporters, policy beneficiaries, result surprises). Note likely gap-up/gap-down candidates.

3

Top 5 Gainers/Losers and 52-week High/Low

Update your watchlist 10–20 minutes after the open—confirm momentum with volumes and news catalysts from Market Live News Updates feeds.

4

Corporate Actions & Disclosures

Check exchange notices for dividends, splits, buybacks, voting results, and press release. Align position sizing with upcoming record dates to avoid settlement surprises.

5

Company Report & Financial Results

For swing or long-term positions, deep-dive into quarterly results and annual reports. Read MD&A and auditor notes—not just headline PAT.

6

IPO & Allotment Status

If applying, track the calendar, issue type, price band, subscription data, and the registrar link for allotment status. Your broker app should notify mandate requests and listing dates.

7

Close and Review

End of day, note index closings, sector rotations, FII/DII flows (when available), and set alerts for tomorrow. This is where Stock Market Analysis turns into a plan - entries, stops, and targets - ready for the next session’s Market Live News Updates.

Imagine Sensex today live shows a sharp +1% surge at the open after a policy hint. The pre-open market revealed gap-ups in autos and banks. Your steps:

App + web to invest in stock market, apply IPO, track allotment status, and monitor Market Live News Updates on the go.

Education via explainers and Stock market Updates on YouTube, plus social posts that decode business fundamentals.

One team to handle account opening, demat queries, and platform walkthroughs—useful if you’re moving from "watcher" to "doer."

If you want a best stock broking company experience anchored in India with a SEBI registered broker, Ganesh StockInvest is designed to be that “single pane of glass” for quotes, execution, and research-oriented guidance.

For anything price - sensitive (results, corporate actions, press release, voting results), use exchange pages first, aggregator second.

Liquidity is different around opens, closes, and long weekends.

Limit single-stock risk, especially around financial results or policy events.

Only with buffers; structure exits before entries.

Let annual reports anchor your conviction; quarterly noise is just that.

For anything price - sensitive (results, corporate actions, press release, voting results), use exchange pages first, aggregator second.

Liquidity is different around opens, closes, and long weekends.

Limit single-stock risk, especially around financial results or policy events.

Only with buffers; structure exits before entries.

Let annual reports anchor your conviction; quarterly noise is just that.

Use Market Live News Updates to stay aware, and rely on structured Stock Market Analysis to stay disciplined. Blend exchange-verified data with a broker platform that’s robust during volatility. With Ganesh StockInvest supporting execution and education, you can elevate your process—from scanning indices watch and Top 5 gainers/losers to placing risk-defined trades and building long-term portfolios via mutual fund investment and direct equity.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily