All you need to know

as a beginner about

stock markets, investments,

trading & more..

When you start your journey in the stock market, it can feel like stepping into a whole new world. From understanding how stocks work to navigating the different strategies, there’s a lot to learn. Stock market trading offers great opportunities, but it’s essential to understand the basics before diving in. In this blog, we’ll go over five must-know tips for stock market beginners that will help you get started confidently.

Before you begin your journey, it’s important to grasp the foundation of stock market trading. The stock market is where investors buy and sell shares of publicly traded companies. When you buy a share, you are essentially purchasing a small ownership stake in a company. As the company grows and becomes more profitable, the value of your shares can increase, and you can earn money when you sell them at a higher price. But remember, the stock market can be volatile, and prices can go down as well.

When it comes to stock market trading basics, the first step is to understand the different types of stock market participants, such as long-term investors and short-term traders. Investors typically hold stocks for an extended period, while traders look for short-term opportunities to make profits. As a beginner, decide which approach suits you best.

Key Terms: Stock Exchange: A marketplace where stocks are bought and sold (e.g., NSE, BSE). Stockbroker: A licensed professional who buys and sells stocks on behalf of clients. Portfolio: A collection of stocks or other investments owned by an individual.Having a firm grasp of stock market trading basics will lay the foundation for your investment journey.

One of the first things every beginner needs to do is choose a reliable stock broker. A stock broker is a professional who facilitates the buying and selling of stocks. Nowadays, you can easily find online brokers who offer user-friendly platforms to help you trade with ease.

A trustworthy stock broker will not only help you execute trades but also guide you on how to start and improve your investment strategies.

Before diving into stock market trading, ask yourself: why are you investing? Different people have different goals when entering the market. Some want to build wealth for retirement, while others may want to fund a major life event like buying a house or paying for education.

Setting clear financial goals will help you:

A clear roadmap will prevent you from making impulsive decisions that could harm your portfolio.

As a beginner, one of the golden rules in stock market trading is diversification. All about stock market success comes down to spreading risk across different types of stocks and sectors. When you diversify your portfolio, you reduce the risk of losing money if one particular stock or sector underperforms.

Diversification protects your investments from sudden market changes and ensures long-term growth, which is vital for beginners.

The stock market can be emotional. The ups and downs of the market can cause beginners to make rash decisions. One of the most critical tips for every stock market beginner is to keep emotions in check and avoid making investment decisions based on fear or greed.

For example, when you see a sudden drop in stock prices, it’s easy to panic and sell everything. However, seasoned investors know that markets fluctuate, and sometimes holding onto a stock through the dips is the best approach. On the flip side, when stocks are rising quickly, you might be tempted to invest heavily without proper research, which can be risky.

Keeping emotions in check is key to successful stock market trading, especially for beginners.

While the five tips above cover the essential aspects of the stock market for beginners, here are a few more to keep in mind:

It’s tempting to jump in with a large sum of money, but as a beginner, it’s better to start small. Invest an amount you can afford to lose while you learn the ropes of stock market trading basics. As you gain more knowledge and confidence, you can gradually increase your investments.

Before buying any stock, make sure to do thorough research. Look into the company’s financial health, growth prospects, and industry trends. Reading all about stock market reports and company performance summaries will help you make informed decisions.

A stop-loss order is a feature that automatically sells your stock if it drops to a certain price. This is a valuable tool to protect yourself from excessive losses, especially when you’re just starting with stock market trading.

Many beginners make the mistake of following what others are doing, especially when they hear news of a “hot stock.” While it’s essential to stay informed, blindly following the crowd without doing your own research can be a recipe for disaster.

Keeping up with the latest financial news will help you stay ahead of market trends and make better investment decisions. However, be cautious about relying too heavily on short-term market forecasts.

Starting your journey in the stock market can be both exciting and overwhelming, but by understanding the stock market trading basics and following these essential tips, you can build a solid foundation for success. Always remember to educate yourself, choose a reliable stock broker, set clear financial goals, diversify your portfolio, and manage your emotions.

If you take the time to learn all about the stock market, you’ll be better prepared to navigate the ups and downs of stock market trading with confidence. By applying these strategies and being patient, you’ll be well on your way to achieving your financial goals through investing.

Happy trading!

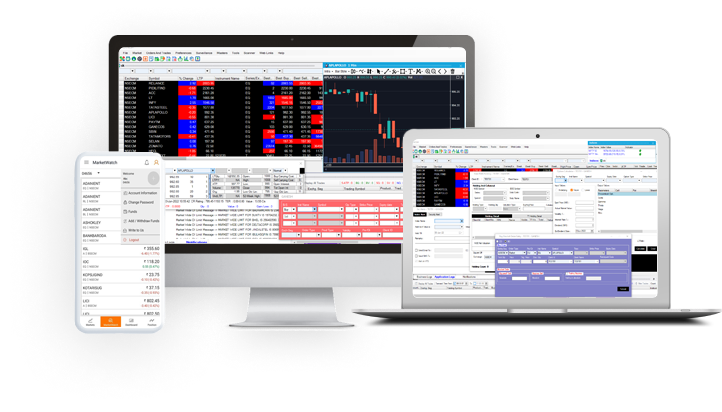

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily