All you need to know

as a beginner about

stock markets, investments,

trading & more..

First, by forming an IPO (initial public offering), a company is listed on the primary market. Next, distribute the stock in the secondary market (exchange). Investors can then buy and sell stock at the appropriate price range.

Yes, you can even invest Rs 500 in the share market, provided you get a stock at that price.

Sensex (Sensitive Index) and Nifty 50 (National Stock Exchange Fifty) are Indian stock indexes. Sensex is the BSE (Bombay Stock Exchange) benchmark index, while Nifty is the NSE (National Stock Exchange) benchmark index. These two platforms can be said to be barometers of the Indian economy.. Learn everything about BSE and NSE.

Stock markets (NSE and BSE) remain open in India from Monday to Friday between 9:15 am to 03:30 pm.

The NSE and BSE pre-open markets start at 9:00 and continue until 9:15. Facilitates trading before normal trading hours. The 15-minute pre-open market was divided into an order entry period (9:00 am – 9:08 am), an order verification period (9:08 am – 9:12 am), and a buffer period (9:12). It remains. AM – 9:15 AM).

IPO (initial public offering) will be revealed when a private company goes public on the primary market and begins selling its shares to institutional investors. Private companies become listed companies.

When an investor buys or sells stock on the same trading day, this is called "daytime". Investors here do not intend to continue investing in the market. They just want to make a profit in a day.

According to experts, the best time to invest in stocks is in the bear market (stocks are on a downtrend). There is a saying that it's easy to make money in a bull market, but you can make a lot of money in a bear market. Pump your money when the market undergoes major modifications. It is likely to make a profit. Here is your question about investing in the Indian stock market. Follow these tips and invest in stocks to build wealth for the future.

The benefits of holding a Demat account are: It is a convenient method of holding equities and bonds in electronic format.There are minimal are chances of fraudulent activities or delay in delivery of shares.Demat accounts reduce paperwork and transaction cost.

It usually takes 48 to 72 hours to open a Demat Account provided you have furnished all the required financial details and documents.

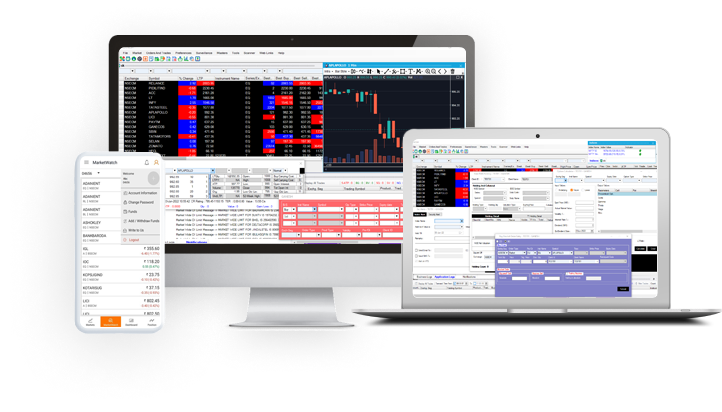

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily