All you need to know

as a beginner about

stock markets, investments,

trading & more..

A covered call refers to transactions in the financial market in which the investor selling call options owns the equivalent amount of underlying security. To execute an investor holds a long position in an asset then sells a call options on that same asset to generate an income stream.

Covered call is neutral strategy where an investor only expects minor fluctuation in market. The main motive is to earn premium and providing a measure of downside protection.

Maximum gain = Strike price – stock purchase price – premium received.

Maximum loss = stock buy price – premium received.

The married put gets its name by combining two investment strategies: stocks and options. In this Strategy an investor, Holing a long position in stock, Purchase at the money put option on the same stock protect against depreciation in stock’s price.

– It is type of vertical spread, it contains two calls with the same expiration but different strikes. The strike price of the short call is higher than the strike of the long call. Buying one call option and selling another at a higher strike price to help pay the cost

Maximum Gain = High strike – low strike – net premium paid.

Maximum loss= Premium paid.

It consist of buying one put option in hopes of profiting from decline in the underlying stock, and writing another put with same expiration , but a lower strike price , as a way to offset some of the cost. This spread generally profit if the stock price moves lower, the potential profit is limited but so is the risk if the stock unexpectedly rally.

Maximum gain = High strike – low strike – net premium paid

Maximum loss = net premium paid.

An investor writes a call option and buys a put option with the same expiration, as a means to hedge a long position in the underlying stock. The investor will select a call strike above and a long put strike below the starting stock price.In return for accepting a cap on the stock’s upside potential, the investor receives a minimum price where the stock can be sold during the life of the collar

Generally an investor take this position, when one is looking for a slight rise in the stock price, but is worried about a decline.

Maximum Gain = call strike – stock purchase price – net premium paid or call strike – stock purchase price + credit received.

Maximum loss= stock purchase price – put strike – net premium paid or stock purchase – put strike – net credit received.

This strategy typically involves buying an out of the money call option and an out of the money put option with same expiration date.

The investor is looking for sharp move in the underlying stock, either up or down, during the life of the options

Maximum gain = Unlimited

Maximum Loss = net premium paid.

- It’s selling a call and put option with the same expiration date, but where the call strike price is above the put strike price. And both options are out of the money. The investor is looking for steady stock price during the life of the options and earn income from selling premiums.

Maximum gain = net premium received

Maximum loss = unlimited.

The iron condor is an options strategy that requires a combination of bullish views and bearish views to make a strategic position. An iron condor is essentially a four-legged trading technique the uses four types of call put options strategies to take maximum advantage of the low volatility of the financial markets. An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date.

Sell an out-of-the-money put

Buy a further out-of-the-money put

Buy a further out-of-the-money call

Iron butterfly strategy is about in which one invests in four options with three different strike prices. One purchases an out-of-the-money put option with a low strike price, then sells a call and a put option with the same at-the-money strike price, and finally purchases an out-of-the-money call option with the highest strike price. Over the life of the options, one profits from the price movement of the underlying asset. It is most advantageous when the underlying asset is expected to be volatile.

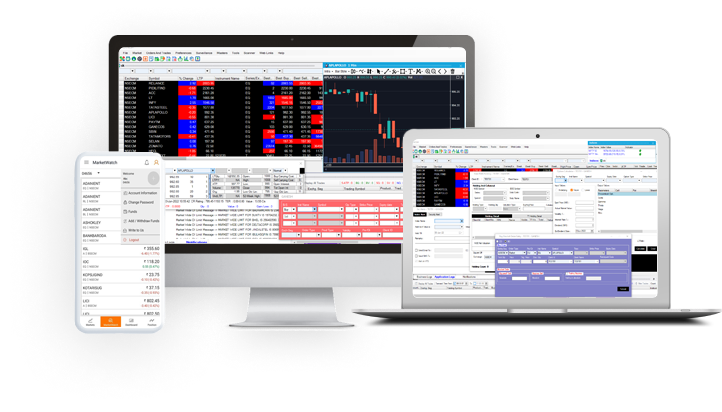

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily