All you need to know

as a beginner about

stock markets, investments,

trading & more..

Arbitrage is a trading strategy aimed at taking advantage of the momentary price difference between the prices of assets on two different exchanges. Arbitrage is the simultaneous buying and selling of the same asset in different markets to take advantage of the slight differences in the market prices of the assets. It takes advantage of short-term price fluctuations in different markets or different forms of the same or similar financial instruments.

A very basic example of arbitrage could look like this. ABC LTD Company’s stock is selling for Rs 100 on the Bombay stock exchange (Sensex) and simultaneously at Rs.100.05 on a different exchange (National stock exchange – NSE). An investor can profit by buying 100 shares of the ABC ltd. company’s stock at Rs.100 and simultaneously selling (or shorting) 100 shares of the stock at Rs.100.05. The buyer then profits from the difference. In this case, their profit would be Rs.5 (100*0.05). These trades are typically executed very quickly so a trader could theoretically conduct dozens of these trades in a single day.

There are two basic types of arbitrage: pure arbitrage and risk arbitrage

The above example is an example of pure arbitrage. Because an asset is being bought and sold at the same time, there is no downside risk. The limitation of pure arbitrage is that many pure arbitrage opportunities are not available to retail investors due to the prevalence of high-frequency trading and computerized systems designed to process data very quickly.

Risk arbitrage implies that the condition causing the price difference may or may not occur. As a result, the trader assumes the risk that a trade will not go as planned. Mergers and acquisitions are one example of this. Since the company that is acquiring the other company typically pays a premium for their shares, an investor can set up a trade to capitalize on this price discrepancy. The risk involved with this kind of trading is the possibility that the merger does not happen. In that case, the trader could be caught holding on to shares that may actually decline in price.

What is PCR? (Not confirmed)

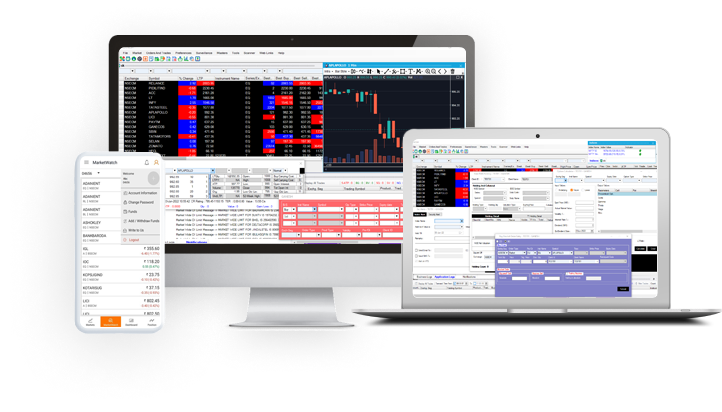

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily