All you need to know

as a beginner about

stock markets, investments,

trading & more..

Investing in the stock market is a popular way to grow wealth over time. However, for beginners, understanding the basics of investment can be overwhelming. This blog will guide you through the fundamental concepts of stock market investment in India, providing you with the essential knowledge needed to start your investment journey.

The stock market is a platform where shares of publicly listed companies are bought and sold. In India, the two primary stock exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Companies list their shares on these exchanges to raise capital, and investors buy these shares to own a portion of the company.

Investing in the stock market offers the potential for higher returns compared to traditional savings methods like fixed deposits. Over time, the stock market has proven to be one of the most effective ways to build wealth. However, it’s essential to understand the risks involved and the basics of investment before diving in.

Before making any investment, it’s crucial to understand the basics of investment. Familiarize yourself with terms like stocks, bonds, mutual funds, and ETFs (Exchange-Traded Funds). Learn about different investment strategies, market trends, and economic factors that influence stock prices.

Open a Demat and Trading Account:In India, to buy and sell shares, you need to open a Demat (short for Dematerialized) and trading account with a registered stockbroker. A Demat account holds your shares in electronic form, while the trading account is used to execute buy and sell orders.

Set Clear Financial Goals:Determine your investment objectives. Are you investing for short-term gains, long-term wealth accumulation, or specific goals like buying a house or funding your child’s education? Your goals will influence your investment strategy.

Start with a Budget:Decide how much money you’re willing to invest. It’s advisable to start small, especially if you’re a beginner. Gradually increase your investment as you gain more confidence and understanding of the market.

A stock represents a share in the ownership of a company. When you buy a stock, you become a part-owner of the company. Stocks are also known as equities.

Bonds:Bonds are debt instruments issued by companies or governments to raise funds. When you invest in bonds, you’re essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value upon maturity.

Mutual Funds:A mutual fund is a pooled investment managed by a professional fund manager. It collects money from multiple investors and invests it in a diversified portfolio of stocks, bonds, or other securities.

Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They offer diversification and are typically less expensive than mutual funds.

This strategy involves investing in stocks that are undervalued compared to their intrinsic value. Value investors look for companies with strong fundamentals but temporarily low stock prices.

Growth Investing:Growth investors focus on companies expected to grow at an above-average rate compared to others. These companies typically reinvest their earnings to expand further.

Dividend Investing:This strategy involves investing in companies that regularly pay dividends. Dividend-paying stocks provide a steady income stream in addition to potential capital appreciation.

Diversification:Diversification involves spreading your investments across different assets, sectors, or geographical regions to reduce risk. A well-diversified portfolio is less likely to suffer significant losses if one investment performs poorly.

Only invest money that you can afford to lose. The stock market can be volatile, and there’s always a risk of losing your investment.

Avoid Herd Mentality:Don’t follow the crowd blindly. Make investment decisions based on thorough research and analysis rather than emotions or market hype.

Set Stop-Loss Orders:A stop-loss order is an instruction to sell a stock when it reaches a specific price. It helps protect your investment from significant losses by automatically selling the stock if its price falls below a certain level.

Stay Informed:Keep yourself updated with the latest market news, economic developments, and company performance reports. This information will help you make informed investment decisions.

This strategy involves holding stocks for several years, allowing your investment to grow as the company expands. Long-term investments benefit from compound growth and are less affected by short-term market fluctuations.

Short-Term Investment:Short-term investments are made with the intent to sell within a short period, usually within a year. This strategy is riskier and requires constant market monitoring, but it can yield quick profits.

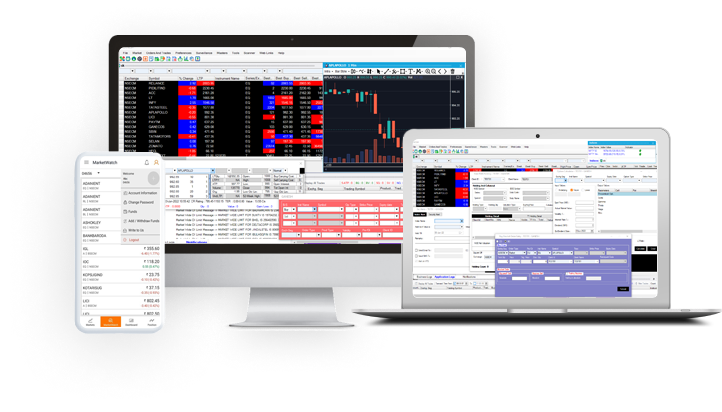

Ganesh StockInvest, a leading stock market broker in India, has been guiding investors for over three decades. They provide a user-friendly platform for trading, along with expert advice and market insights. Whether you’re a beginner or an experienced investor, Ganesh StockInvest offers the tools and resources you need to make informed investment decisions.

Understanding the basics of investment in the stock market is the first step toward building wealth. By educating yourself, setting clear goals, and developing a sound investment strategy, you can navigate the complexities of the stock market with confidence. Remember, patience and discipline are key to successful investing, and with time, your investments can help you achieve your financial goals.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily