All you need to know

as a beginner about

stock markets, investments,

trading & more..

Investing in the stock market offers multiple strategies, each catering to different goals, risk appetites, and timelines. Among the most popular are day trading and long-term investing. While both approaches aim to make profits, they differ significantly in execution, mindset, and potential outcomes. Understanding these differences can help you determine which strategy aligns with your financial goals and lifestyle.

Day trading involves buying and selling stocks within a single trading day, with the aim of making quick profits from short-term price fluctuations. Traders closely monitor stock prices, use technical analysis, and execute multiple trades daily.

Trades are closed by the end of the day, avoiding overnight risks.

Day traders thrive on market movements and fluctuations.

Successful day traders need to act swiftly and confidently.

This strategy requires constant monitoring of the market during trading hours.

Gains can be realized daily if trades are successful.

Since positions are closed daily, there’s no exposure to after-hours market changes.

Ideal for those who enjoy the thrill of constant trading.

Rapid trades can lead to substantial losses.

Frequent transactions can result in significant brokerage fees and taxes.

The fast-paced nature of day trading can be stressful.

Long-term investing focuses on holding stocks for years, or even decades, to benefit from sustained growth and compound returns. This strategy often involves fundamental analysis to identify quality stocks with strong potential.

Investments are held for extended periods to maximize growth.

Short-term market fluctuations are less impactful.

Reinvesting dividends and returns enhances wealth accumulation.

Less daily involvement compared to day trading.

Leverages the power of compounding to grow investments.

Less need to track daily market movements.

Gains are taxed at lower long-term capital gains rates.

Fewer transactions mean lower brokerage fees and taxes.

It may take years to see substantial returns.

Long-term exposure to the market can involve periods of losses.

Funds are tied up in investments for extended periods.

| Aspect | Day Trading | Long-Term Investing |

|---|---|---|

| Time Horizon | Intraday (within a single day) | Years or decades |

| Risk Level | High | Moderate |

| Involvement | Active and intensive | Passive and relaxed |

| Focus | Short-term price movements | Fundamental stock value |

| Transaction Costs | High due to frequent trading | Low due to fewer transactions |

| Emotional Impact | High stress, constant decision-making | Low stress, long-term patience |

Use day trading for a portion of your portfolio to explore short-term opportunities.

Allocate the majority to long-term investments for steady growth and risk management.

Start Small:

Begin with limited capital to minimize losses.

Set Limits::

Establish clear profit and loss thresholds to avoid emotional decisions.

Practice Discipline:

Stick to your strategy and avoid impulsive trades.

Use Tools:

Utilize trading software and platforms for analysis and execution.

Stay Informed:

Keep up with news and market trends.

Diversify:

Spread investments across sectors to reduce risk.

Think Long-Term:

Focus on a company’s potential growth rather than short-term market fluctuations.

Reinvest

Dividends: Use returns to buy more shares for compounding benefits.

Be Patient:

Resist the urge to react to market dips.

Review Periodically:

Evaluate your portfolio periodically and adjust as needed.

develop the right Strategy:

Create a well-thought-out plan and practice disciplined investing.

Investing in the stock market is a powerful tool for wealth creation. Whether through day trading or long-term investing, it allows individuals to:

Grow wealth over time.

Achieve returns that outpace inflation.

Complement other income streams.

Be part of the success of companies and industries.

Choosing between day trading and long-term investing depends on your financial goals, risk tolerance, and time availability. Both strategies have their merits and challenges, and understanding their nuances is key to making informed decisions. By carefully evaluating your preferences and staying disciplined, you can succeed in investing in the stock market, no matter which strategy you choose.

Whether you seek the excitement of day trading or the steady growth of long-term investing, the stock market offers opportunities for everyone. Start small, stay informed, and focus on your goals to make the most of your investment journey.

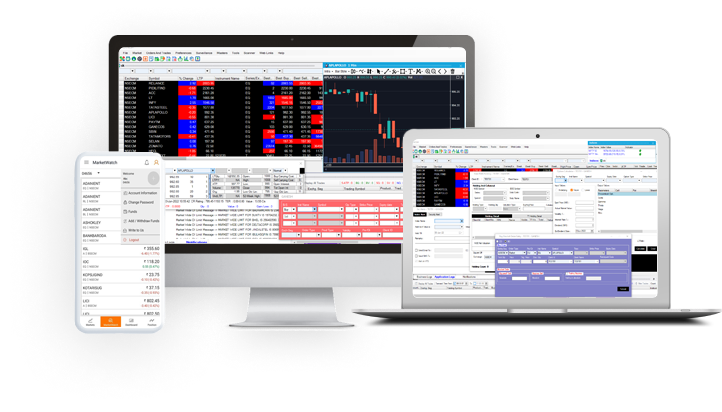

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily