Top Stock Broker Company in India for Your Stock Market Investments

The equity market, commonly known as the stock market, encompasses more than just company stocks; it includes a diverse array of financial instruments. It acts as a crucial avenue for companies to raise capital and for investors to participate in trading activities, acquiring shares or ownership stakes in promising ventures to foster wealth growth. Amidst this dynamic landscape, Ganesh StockInvest emerges as a prominent player in India's equity market, offering investors unparalleled opportunities. Stay informed about market trends and evolving strategies to make well-informed decisions and maximize returns with this best leading stock market company.

Value investors typically invest in well-established businesses that have shown steady profitability on a lengthy period of time, which will offer regular investment income.

Growth investors seek out companies with exceptionally large development possible, hoping to achieve the greatest appreciation in the share price.

Everyone wants to own a stocks that grows ten times or gave multibeggar returns in value, see mutual funds making an (15-20)% return, and become wealthier. Sadly, lots of people start investing without planning first. This can make their journey to financial growth bumpy and not as easy as they'd like. Understanding all about stock market dynamics and conducting thorough stock market analysis are essential components of successful investing.

Open Demat account for Free from a reputable and reliable brokerage firm like Ganesh StockInvest. Choose an account type that aligns with your investment needs and preferences.

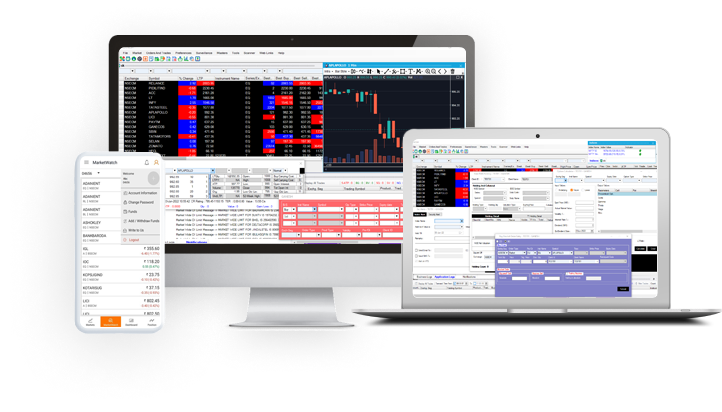

Mobile Application: Ganesh StockInvest provides you hassle-free Mobile application that allows you to invest in the stock market, trade in equity shares, Apply IPOs online, Future & Option (F&O), Currency trading, Mutual Funds, Bonds, and many more services

We also provide you the Online Portal of Ganesh StockInvest called Gdhan terminal, and also back office login (here you can see your daily basics transactions). Gdhan mobile application is available for iOS and Android devices which allows you daily market updates.

Financial Knowledge: Gain a solid understanding of how the stock market operates, including basic concepts like stock valuation, market trends, and risk management strategies, stock market tips for beginners This comprehensive knowledge equips you to invest, trade, and expand your wealth through the Gdhan App across a diverse range of financial instruments including share market stocks, US stocks, IPOs, Mutual Funds, Commodities, Futures, and Options (F&O), Currency etc.

Investment Goals: Define clear investment objectives, whether it's wealth accumulation, retirement planning, or achieving specific financial milestones. Align your investment decisions with these goals.

Risk Tolerance: Assess your risk tolerance level to determine how much volatility you can withstand in your investment portfolio. This helps in selecting suitable investment options.

Emergency Fund: Build an emergency fund to cover unexpected expenses or financial setbacks. This ensures that you won't need to liquidate your investments prematurely during times of crisis

Diversification: Spread your investments across different asset classes, industries, and geographic regions to reduce risk exposure. Diversification helps balance potential losses and gains in your portfolio.

Research and Analysis: Cultivate patience and discipline as essential virtues for successful investing. Avoid making impulsive decisions based on short-term market fluctuations, and stick to your long-term investment strategy.

Equity and Derivative: Equity investments involve purchasing shares of ownership in companies, while derivatives are financial contracts whose value is derived from an underlying asset. Both offer opportunities for profit and risk management in the financial markets, F&O, and hedging.

Currency: Currency trading involves buying and selling foreign currencies in the foreign exchange market. Investors can capitalize on fluctuations in exchange rates to make profits or hedge against currency risks in international transactions.

Mutual Funds: Mutual Funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way for investors to access professional management and diversification in their investment portfolios.

IPO: An Initial Public Offering (IPO) is the process by which a private company offers its shares to the public for the first time. Investors can participate in IPOs to potentially profit from the company's growth and future performance.

Research: Research is essential for informed decision-making in investing. It involves analyzing financial data, market trends, company fundamentals, and economic indicators to identify investment opportunities and assess potential risks.

International Investing: International investing involves buying and selling securities of companies or assets located outside one's home country. It offers diversification benefits and exposure to global economic growth but also carries risks related to currency fluctuations and geopolitical events.

Fixed Income/ Bonds: Fixed income investments, such as bonds, provide investors with regular interest payments and return of principal at maturity. Bonds offer income stability and capital preservation but are subject to interest rate and credit risk.

LAS/LAP: Loan Against Securities (LAS) and Loan Against Property (LAP) are forms of secured loans where borrowers pledge securities or property as collateral to obtain funds from financial institutions. These loans offer lower interest rates compared to unsecured loans and can be used for various purposes

Real estate in the stock market refers to investments in companies that operate within the real estate sector. These companies can include real estate investment trusts (REITs), property management firms, homebuilders, and real estate development companies. Invest in real estate stocks provides an opportunity for investors to gain exposure to the real estate market without directly owning physical properties. It offers diversification benefits to portfolios, potential for dividend income, and the ability to capitalize on trends in the housing market. However, like any investment, real estate stocks come with risks including market volatility, interest rate fluctuations, and economic downturns.

Share is referred to by different names like equity, financial security, and so forth. A person carrying a share of a company retains that part of possession in that company. Someone holding maximum stocks moves maximum ownership and designated like director, chairman, etc.. To learn about how you can earn on the stock exchange has to understand how it works.

The stocks will be saved in Demat account in electronic format. Index at share market Index consists of a group of shares. Index denotes the management of the entire marketplace. Like when folks say the market is going up or down means Index is going up or down. The Index is made up of market capitalization and high liquidity shares.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily