All you need to know

as a beginner about

stock markets, investments,

trading & more..

Initial Public Offerings (IPOs) are exciting opportunities for investors to become part-owners of a company by purchasing its shares when it first goes public. However, applying for an upcoming IPO can be a complex process, especially for first-time investors. This blog will guide you through everything you need to know to apply upcoming IPOs, helping you make informed decisions and maximize your investment potential.

An IPO, or Initial Public Offering, is when a private company offers its shares to the public for the first time. By doing so, the company raises capital from investors, which can be used for various purposes such as expansion, paying off debts, or funding new projects. For investors, an IPO provides an opportunity to invest in a company at an early stage, often at a lower price compared to when the shares are traded on the stock market later.

If the company performs well after going public, the value of its shares may increase, leading to significant gains for early investors.

Ownership in a Growing Company:By investing in an IPO, you become a shareholder and part-owner of the company, giving you a stake in its future success.

Access to Promising Companies:IPOs often involve companies with strong growth potential. Getting in early allows you to invest in these companies before they become widely known.

If you’re interested in applying for an upcoming IPO, here’s a step-by-step guide to help you through the process.

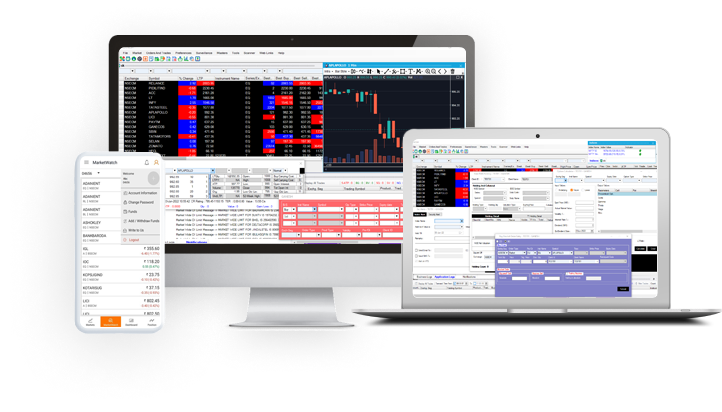

To apply for an upcoming IPO, you need to have a Demat account and a trading account with a registered stockbroker. Ganesh StockInvest, a trusted full-service stock broker company for over three decades, offers comprehensive solutions for all your stock market needs. Here, you can open a Demat account for free with minimal documentation, making it quick and easy to start investing. The Demat account holds your shares in electronic form, while the trading account allows you to buy and sell shares in the stock market. We also provide robust back-office services to support your trading activities. For convenient access, our mobile application is available on both Android and iOS platforms, allowing you to manage your investments anytime, anywhere.

If you don’t have these accounts yet, you can easily open them with us—just a call away.

Keeping track of upcoming IPOs is crucial. You can find information on IPOs through financial news websites, stock market apps, or your broker’s platform. Staying informed will help you identify the companies you want to invest in and prepare for the application process.

This is the range within which the IPO shares will be offered. The final price will be decided based on investor demand.

Lot Size:The minimum number of shares you need to apply for in an IPO.

Issue Dates:The period during which you can apply for the IPO.

Company Prospectus:This document provides detailed information about the company, its financials, and the risks involved in investing.

Decide the amount you want to invest in the IPO. It’s important to assess your financial situation and risk tolerance before deciding. Remember that investing in IPOs can be risky, so it’s wise to diversify your investments rather than putting all your money into one IPO.

Once you have decided to apply upcoming IPO, you can do so online through your broker’s platform or your bank’s net banking service. Here’s how:

Through Your Broker: Log in to your trading account, navigate to the IPO section, select the IPO you want to apply for, enter the number of lots you wish to buy, and submit your bid.

Through ASBA (Application Supported by Blocked Amount):ASBA or UPI mandate is a facility provided by banks that allows you to apply for an IPO. Your bid amount is blocked in your account and only debited if you are allotted shares. Log in to your bank’s net banking portal, go to the IPO section, select the IPO, enter the details, and submit your application.

After the IPO application window closes, the company will allocate shares to investors based on demand. If the IPO is oversubscribed (meaning more shares were applied for than available), you may receive fewer shares than you applied for or none at all. You can check the allotment status on the registrar’s website or through your broker’s platform.

If you are allotted shares, they will be credited to your Demat account. You can then choose to hold onto them as a long-term investment or sell them on the stock market when the company’s shares are listed.

Once the shares are listed on the stock exchange, you can start trading them. The listing price may differ from the IPO price depending on market demand. If the demand is high, the listing price may be higher, potentially offering you instant gains.

Before you apply upcoming IPO, research the company thoroughly. Look at its business model, financial health, and growth prospects to make an informed decision.

Read the Prospectus:The company’s prospectus provides vital information about the IPO and the risks involved. Make sure to read it carefully.

Diversify Your Investments:Don’t put all your money into a single IPO. Spread your investments across different opportunities to manage risk.

Be Cautious of Hype:Not all IPOs perform well after listing. Be cautious of hype and base your decisions on solid research and analysis.

Use ASBA for IPO Application:: ASBA is a safer and more convenient way to apply upcoming IPOs as it allows you to block funds rather than debiting your account immediately.

Applying for upcoming IPOs can be a rewarding experience if done correctly. By following the steps outlined in this guide, you can navigate the process with confidence and increase your chances of success. Whether you’re a first-time investor or have experience in the stock market, understanding how to apply upcoming IPOs will help you make the most of these investment opportunities.

Remember, while IPOs offer the potential for high returns, they also come with risks. Always do your due diligence before deciding to apply for an upcoming IPO. With careful planning and research, you can build a strong portfolio and achieve your investment goals.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily