All you need to know

as a beginner about

stock markets, investments,

trading & more..

The year 2025 is set to be an exciting one for stock market investors, with several companies planning to go public. Investing in upcoming IPOs in 2025 can be a great opportunity for those looking to enter the stock market early and gain significant returns. In this blog, we will explore upcoming IPOs 2025, important dates, how to apply for new IPOs, and how Ganesh StockInvest can help you navigate the process effortlessly.

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. IPOs are a gateway for retail investors to invest in a company at its early stage and potentially benefit from future growth. The demand for upcoming IPOs 2025 is expected to be high, making it crucial for investors to stay updated on the current & upcoming IPO list and their respective IPO details.

Study the company’s financial statements, revenue growth, and business model to assess its potential for future growth.

Compare the company's IPO price with its earnings and competitors to ensure you’re not overpaying.

Stock market sentiment plays a crucial role in determining how an IPO performs after listing. A strong market often leads to higher IPO demand.

Check whether the industry is growing or declining, as this can impact the company's long-term success.

Analyze past IPO trends to understand how similar companies have performed post-listing.

Study the company’s financial statements, revenue growth, and business model to assess its potential for future growth.

Check whether the industry is growing or declining, as this can impact the company's long-term success.

Compare the company's IPO price with its earnings and competitors to ensure you’re not overpaying.

Analyze past IPO trends to understand how similar companies have performed post-listing.

Stock market sentiment plays a crucial role in determining how an IPO performs after listing. A strong market often leads to higher IPO demand.

Many investors search for the upcoming IPO this week to stay informed about the latest IPO launches.

Ganesh StockInvest provides real-time updates and IPO details to help investors make informed decisions.

Keeping track of the current & upcoming IPO list ensures you never miss a good investment opportunity.

Start your IPO journey without any account opening charges.

Get real-time updates on upcoming IPOs 2025, stock trends, and investment opportunities.

We provide a secure and user-friendly platform for all stock market investments.

Apply for IPOs quickly and easily from our platform.

Our team provides guidance on investing in IPOs and stock markets.

From equity trading to IPO investments, Ganesh StockInvest covers all your stock market needs.

Don’t invest just because of hype; study the company’s financials.

Define your strategy—whether you want quick gains or long-term investment.

Keep track of industry and economic trends affecting IPO performance.

IPOs can be volatile; be prepared for short-term fluctuations.

Higher demand can lead to oversubscription, so apply as soon as the IPO opens.

The year 2025 offers a great lineup of upcoming IPOs 2025, and investors should stay updated with the current & upcoming IPO list and their IPO details. Whether you are a beginner or an experienced investor, Ganesh StockInvest makes it easy to apply for upcoming IPOs this week and invest in the stock market with confidence.

Stay ahead of the market— open free Demat account on Ganesh StockInvest today and start applying for your favorite IPOs!

Additionally, Ganesh StockInvest provides the latest IPO-related updates, insights, and expert analysis to help you make informed investment decisions. By leveraging our platform, you can efficiently track the list of upcoming IPOs and maximize your investment opportunities in 2025.

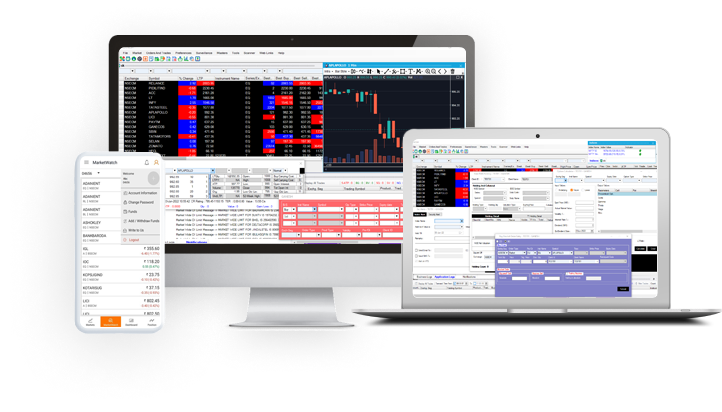

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily