All you need to know

as a beginner about

stock markets, investments,

trading & more..

A derivative refers to a type of contract. Derivatives are essentially contracts whose value is derived from an underlying asset. The underlying asset can be a financial asset or a commodity. The value of the underlying asset keeps changing according to market conditions. In basic term, the value of the derivative product will fluctuate in response to changes in the underlying asset's value Financial Derivatives: Derivatives derived from financial assets are known as financial derivatives. Financial assets include equity, interest rates, currencies, Index etc. For example, equity is a Derivative whose underlying asset is stock. In other words, it serves as a guarantee that you will buy the asset at some point in the future. The derivative contract specifies the exact date and price.

Futures are derivative financial contracts which provide the holder of the contract the right to buy and sell the underlying asset at future time at a price that is agreed upon at the time of entering into the contract. “Futures contract" and "futures" refer to the same thing.Future contract are negotiable, standardized and contract holder has the right to transfer the contract obligations to a third party before expiry date. For example, Investor A requires 1000 Kg of sugar on March 31st to meet production needs. On January 1st, investor A enters into a future contract in sugar, which we assume is designed to purchase 100kg of sugar. On January 1, Investor A will purchase 10 Sugar future contracts, and if the price is 5000, Mr. X will pay 50,000 to purchase 1000Kg of sugar. When the contract matures on March 31, Mr. x will pay INR 50K and the seller will deliver 1000 Kg of sugar.

Options are a type of derivative, so the value of the underlying asset determines its value. You can use stocks, indexes, currencies, commodities, or other securities as underlying assets. Now that we have defined options, let's take a look at option contracts. A financial contract that gives an investor the right to buy or sell an asset at a specified price by a specified date is called an option contract. However, it includes the right to purchase, but not the obligation to purchase.

The main difference between option contracts and futures contracts is that future holders must fulfill their contract obligations regardless of whether the holder's position is contractual or not. However, option contract holders have the option of not having to fulfill their obligations if a position causes a loss.

There are two types of options: call and put.Form buyer perspective, when an investor expecting up movement in the market.

Form buyer perspective, when an investor expecting fall in the market.

Options can also be categorized into American and European options based on exercise style.

These options are that can be exercised at any time until the expiration date. Some of the security options available from NSE are American style options.

These options can only be exercised on the maturity date. All index options traded on NSE are European options.

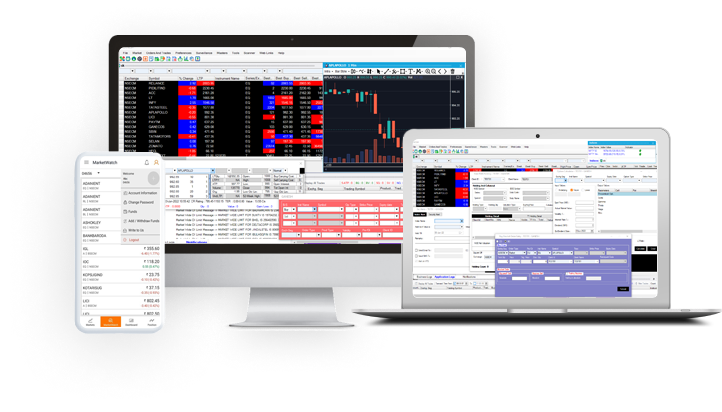

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily