All you need to know

as a beginner about

stock markets, investments,

trading & more..

Investing in the stock market can be one of the most effective ways to build wealth and achieve financial goals. Understanding why to invest in the stock market and the benefits it offers is crucial for any aspiring investor. Here is a comprehensive guide to help you grasp these concepts in a very simple way.

One of the primary reasons why to invest in the stock market is the potential for high returns. Historically, stocks have outperformed other asset classes such as bonds, real estate, and savings accounts. Although they come with higher risks, the potential for significant capital appreciation makes them an attractive investment.

Many companies distribute a portion of their profits to shareholders through dividends. These regular payments can provide a steady stream of income, which can be particularly beneficial for retirees or those seeking passive income. Reinvesting dividends can also help compound your returns over time.

When you buy stocks, you purchase a share of ownership in a company. This ownership entitles you to a portion of the company’s profits and gives you voting rights on important corporate matters. As a shareholder, you have the opportunity to benefit from the company’s growth and success.

The stock market offers a wide range of investment opportunities across various sectors and industries. This diversity allows you to spread your investments and reduce the overall risk in your portfolio. Diversification can balance the performance of different investments, stabilizing your portfolio’s returns.

Stocks are generally liquid investments, meaning they can be easily bought and sold on the stock exchanges. This liquidity allows investors to quickly convert their holdings into cash if needed. The ease of trading stocks adds a layer of flexibility to your investment strategy.

Investing in the stock market can help protect your wealth against inflation. Over the long term, stocks have typically outpaced inflation, ensuring that your purchasing power is preserved. This is particularly important in periods of high inflation where the value of cash and fixed-income investments might erode.

Investing in the stock market offers the potential for substantial wealth creation over time. By investing in well-performing companies, you can benefit from capital gains as their stock prices increase. Compounding returns, especially when dividends are reinvested, can significantly grow your investment portfolio.

Including stocks in your investment portfolio can help diversify your assets, reducing the overall risk. Diversification ensures that your portfolio is not overly reliant on a single type of investment, balancing the performance across different asset classes and industries.

Through mutual funds and exchange-traded funds (ETFs), you can access professional management of your investments. Fund managers make decisions on buying and selling stocks based on extensive research and analysis, potentially improving your investment outcomes.

The stock market provides access to a broad spectrum of companies across different sectors and industries, both domestically and internationally. This allows you to invest in innovative and growing companies worldwide, further enhancing your portfolio’s diversification.

By investing in the stock market, you participate in the growth of the economy. As companies expand and generate profits, their stock prices generally rise, benefiting shareholders. This means that your investments can grow in line with the broader economy, providing opportunities for significant returns.

Stocks that pay dividends provide regular income, which can be particularly beneficial for those seeking a reliable source of funds. Dividends can offer a stable income stream irrespective of stock market fluctuations, making them an attractive option for income-focused investors.

The stock markets in India are regulated by the Securities and Exchange Board of India (SEBI), which ensures a fair and transparent trading environment. This regulatory oversight protects investor interests and enhances the integrity of the market.

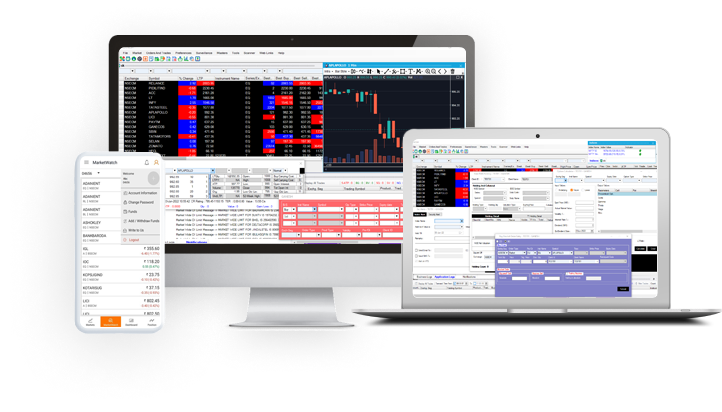

Online trading platforms and mobile apps have made investing in the stock market more accessible and convenient. Investors can easily track their investments, execute trades, and access research and analysis tools. These technological advancements have democratized stock market investing, making it available to a broader audience.

Long-term investing involves holding stocks for several years to benefit from the company’s growth. This strategy requires patience and a focus on the fundamentals of the companies you invest in. Over time, long-term investing can yield substantial returns as the companies grow and their stock prices increase.

Short-term trading involves buying and selling stocks within a short period to capitalize on market volatility. This strategy requires a good understanding of market trends and technical analysis. While it can be profitable, short-term trading is also riskier and demands more time and attention.

Value investing involves identifying undervalued stocks with strong fundamentals and buying them at a discount. This strategy is based on the belief that the market will eventually recognize the stock’s true value, resulting in price appreciation. Value investors focus on companies with solid financial health and strong growth potential.

Growth investing involves investing in companies with high growth potential, even if their current valuations are high. This strategy focuses on companies that are expected to grow significantly in the future, leading to substantial capital gains. Growth investors prioritize companies with innovative products, strong market positions, and expanding revenues.

Understanding why to invest in the stock market and recognizing its benefits can help you make informed investment decisions. The stock market offers potential for high returns, dividend income, ownership in companies, diversification, liquidity, and a hedge against inflation. Additionally, investing in stocks can lead to substantial wealth creation, portfolio diversification, professional management, and participation in economic growth. With technological advancements and regulatory protection, stock market investing has become more accessible and transparent. Whether you’re a long-term investor, a short-term trader, a value investor, or a growth investor, the stock market provides opportunities to achieve your financial goals.

By educating yourself, choosing the right broker - Ganesh StockInvest, and implementing a sound investment strategy, you can take advantage of the benefits of stock market investing and work towards building a secure financial future.

for what reason; the future is unknown to anyone. As a result, all you can do is save money, which is extremely important.

A retirement plan can assist you in making the best investments for your future, where you will never have to rely on your children to cover your expenses. Trust me when I say that relying on your children for basic necessities is a horrible feeling.

There are two ways for stocks to make money for their owners. Capital gains and dividends

Stock, Mutual Funds returns generally outpace inflation.

Stocks have outperformed other investments in terms of long-term performance.

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily