All you need to know

as a beginner about

stock markets, investments,

trading & more..

The Indian stock market has evolved significantly over the years, shifting from physical share certificates to an efficient digital format known as dematerialization. Investors who still hold physical shares must convert them into electronic form for seamless stock market trading.This process enhances security, eliminates the risk of loss or forgery, and allows smooth transactions. In this blog, we will discuss the step-by-step process of converting physical shares into a demat account and why it is crucial to invest in stock market through a dematerialized format.

A Demat account, short for Dematerialized Account, is an electronic repository that holds financial securities such as shares, bonds, and mutual funds in a digital format. It eliminates the need for physical certificates and ensures a seamless trading experience in the stock market.

Easy Management:

Investors can buy, sell, and track their investments effortlessly.

Faster Transactions:

Eliminates the need for physical paperwork, making trading quick and hassle-free.

Cost-Effective::

Reduces costs associated with handling and storing paper certificates.

Transparency:

Provides real-time updates on stock holdings and transactions.

Dematerialization is the process of converting physical share certificates into electronic form, making them easier to trade and manage. This transition ensures greater security and efficiency in stock market trading.

Opening a Demat Account:

Investors must open demat account with a Depository Participant (DP).

Submitting Physical Share Certificates

Investors need to provide their physical certificates for conversion

Verification & Approval

The registrar and transfer agent (RTA) verify the shares before approving the request.

Electronic Transfer:

Once approved, the shares are credited to the investor’s Demat account.

Holding shares in electronic form has numerous advantages, making it a preferred choice for investors looking to participate in stock market trading.

Security:

Eliminates risks like theft, forgery, or misplacement of physical share certificates.

Convenience:

Allows easy transfer and trading of shares without physical documentation.

Faster Settlements:

The process of buying and selling shares is much quicker compared to physical transactions.

Automatic Credit of Benefits:

Any corporate actions like dividends, bonus shares, or stock splits are automatically credited to the Demat account.

SEBI Mandate:

The Securities and Exchange Board of India (SEBI) has made it mandatory for investors to hold shares in demat form to trade in the Indian stock market.

| Feature | Dematerialization | Re-materialization |

|---|---|---|

| Definition | Converting physical shares to electronic format | Converting electronic shares back to physical format |

| Purpose | Enables smooth stock market trading | Required if an investor prefers holding physical shares |

| Security | Highly secure, eliminates risks of loss or forgery | Prone to risks like loss, damage, and fraud |

| Process | Conducted through a Depository Participant (DP) | Conducted by submitting a request to the DP |

Step 1: Open a Demat Account - To convert physical shares, you first need to open a demat account with a Depository Participant (DP), which is registered with NSDL or CDSL.

Step 2: Fill the Dematerialization Request Form (DRF) - Obtain the DRF from your DP and fill in the required details.

Step 3: Submit Physical Share Certificates - Submit the DRF form along with the original physical share certificates to your DP.

Step 4: DP Verification and Forwarding to the Registrar - Your DP verifies and forwards your request to the respective Registrar.

Step 5: Approval from the Company and Depository - The company and the RTA verify and approve your request, and shares are credited to your Demat account.

Step 6: Confirmation of Dematerialization - Once successful, you’ll receive a confirmation from your DP, and the shares are now electronically held.

Dematerialization Request Form (DRF),

Original Physical Share Certificates,

PAN Card Copy,

Aadhaar Card Copy,

Cancelled Cheque (for bank details verification),

Address Proof (Utility Bill or Bank Statement).

Step 1: Visit Ganesh StockInvest's Website or Office and reach out to their team for guidance.

Step 2: Fill the Demat Account Opening Form with your details such as name, PAN card, Aadhaar card, and bank details.

Step 3: Submit Required Documents to ensure smooth KYC verification.

Step 4: Complete the In-Person Verification (IPV) for identity validation.

Step 5: Receive your Demat Account details after completing the process and login credentials.

Effortless Demat Account Opening

Guidance on Dematerialization Process

Personalized Customer Support

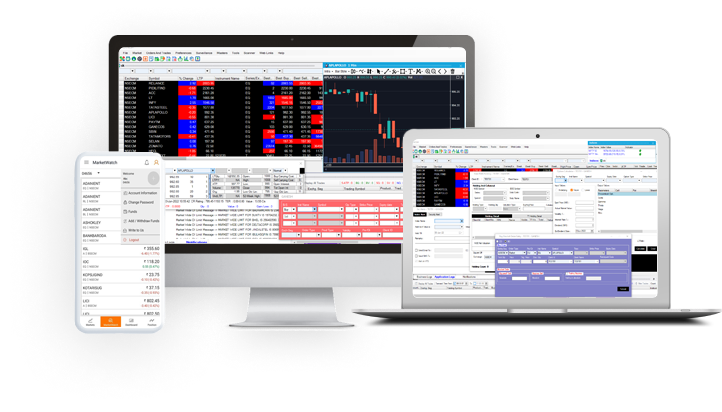

Robust Online Trading Platform

Expert Market Insights for Smart Investments

If you are looking for the best stock broker in India, Ganesh StockInvest is a reliable choice to help you with all your stock market trading and demat needs.

Converting your physical shares into a demat account is essential for seamless stock market trading and investment security. With a full-service stock broker company like Ganesh StockInvest, you can ensure a smooth and hassle-free dematerialization process.

If you still hold physical shares, now is the time to convert them and invest in the stock market confidently. Whether you are a seasoned investor or a beginner, choosing the best stock broker in India can make all the difference in managing your investments efficiently.

For expert assistance, open your demat account with GANESH STOCKINVEST today and take your investments to the next level!

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily