All you need to know

as a beginner about

stock markets, investments,

trading & more..

Stock market trading has become a powerful tool for individuals looking to build wealth and secure their financial future. With the rise of digital platforms and increased financial awareness, more people are now exploring this exciting world. But before jumping in, it’s crucial to understand the stock market trading basics.

In this blog, we’ll guide you through everything a beginner needs to know about trading in the stock market—how it works, key terms, how to get started, and News to stay informed. We'll also cover how to choose a stock broker, the steps for how to do stock market trading, and how to apply for upcoming IPOs.

Stock market trading is the process of buying and selling shares of publicly listed companies through a stock exchange such as the NSE or BSE in India. Traders aim to make a profit based on the price fluctuations of these stocks.

Stocks

Units of ownership in a company.

Stock Exchange

A platform where stocks are bought and sold.

Stock Broker

A registered intermediary that executes buy and sell orders on your behalf.

Demat Account

Begin your stock market journey by choosing to open Demat account — a digital account to hold your stocks in electronic form — with a reliable broker.

Trading Account

An account to place buying/selling orders in the market.

Learning the stock market trading basics gives you the confidence to make informed decisions and avoid costly mistakes. Understanding market trends, company fundamentals, and economic indicators can significantly improve your trading results.

Additionally, knowledge of stock trading ensures you don't fall for speculative traps and can differentiate between short-term trends and long-term investments.

A stock broker plays a vital role in your trading journey. They provide you with the trading platform, market research, and customer support to navigate the markets.

Popular stock brokers in India include Zerodha, Groww, Upstox, Ganesh StockInvest, Angel One, and ICICI Direct. Always read reviews and compare services before finalizing.

An Initial Public Offering (IPO) is when a company offers its shares to the public for the first time. Many investors look to apply upcoming IPO to capitalize on early growth opportunities, especially if the company has strong fundamentals and market demand..

Always read the prospectus and understand the company’s business model before you apply upcoming IPO, ensuring you make well-informed investment decisions.

Begin with small investments until you understand market behavior.

Follow financial news and track global and domestic economic indicators.

This protects your capital by limiting potential losses.

Avoid putting all your money in one stock.

Stick to your strategy, and don’t panic with short-term market movements.

Mastering stock market trading basics takes time but pays off in the long run.

Blindly following tips or trends can lead to losses.

Trying to time the market perfectly often results in poor decisions.

Trading too frequently can lead to higher brokerage costs and emotional stress.

Not setting a stop-loss can lead to bigger losses.

With the right mindset and understanding of how to do stock market trading, you can build a solid trading journey.

Understanding the stock market trading basics is the first step toward becoming a confident investor or trader. With the right knowledge, a trustworthy stock broker, and a disciplined approach, you can navigate the ups and downs of the market wisely.

Don't forget the opportunities that IPOs present. If researched well, knowing how to apply upcoming IPO at the right time can offer significant gains. Take your time, learn continuously, and most importantly—start small. The stock market rewards patience and knowledge more than luck and guesses.Take your time, learn continuously, and most importantly—start small. The stock market rewards patience and knowledge more than luck and guesses.

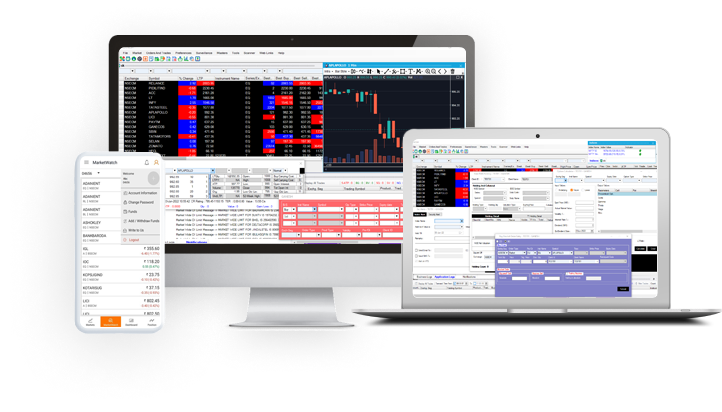

Open NSE & BSE trading account with ease using the app

Monitor your orders anytime from anywhere

View weekly and monthly Technical Charts

Transfer funds easily